Sanford DeLand/Buffettology Fund

Disclaimer: The following information about the Sanford DeLand / Buffettology Fund is provided for information purposes only.

NOTE: This Fund is not available for investment by any person or entity in the United States of America.

About Keith Ashworth-Lord

CIO of Sanford DeLand Asset Management and Manger of Buffettology Fund

Biography

Keith Ashworth-Lord-Biography Of Sanford DeLand Asset Management Ltd

Video Interview (May 8, 2020)

Keith Ashworth-Lord, CIO of Sanford DeLand Asset Management and Manager of Buffettology Fund in conversation with Tamzin Freeman on how he has had to react and adapt to the current crisis.

piworld Thursday webinar: Keith Ashworth-Lord, CIO, Sanford Deland Buffettology Fund

Video Interview

Keith Ashworth-Lord, Sanford DeLand, Chief Investment Officer, The UK Buffettology Fund. Keith was inspired by Benjamin Graham, which led him to Buffett. Keith views his investments as a Business Manager, rather than a Fund Manager. An approach which has rewarded him, with Return on Investment of c.200% since he launched the Buffettology Fund in 2014. This outstanding performance has seen investors flocking to his fund, with FUM at £1bn as at June 2019, up from £0.5 billion in January 2019!

In this interview Keith outlines his investing caveats, which underpin his inspiring investment performance.

In The News links

Articles links

Buffettology: The British Fund That Beat The Master

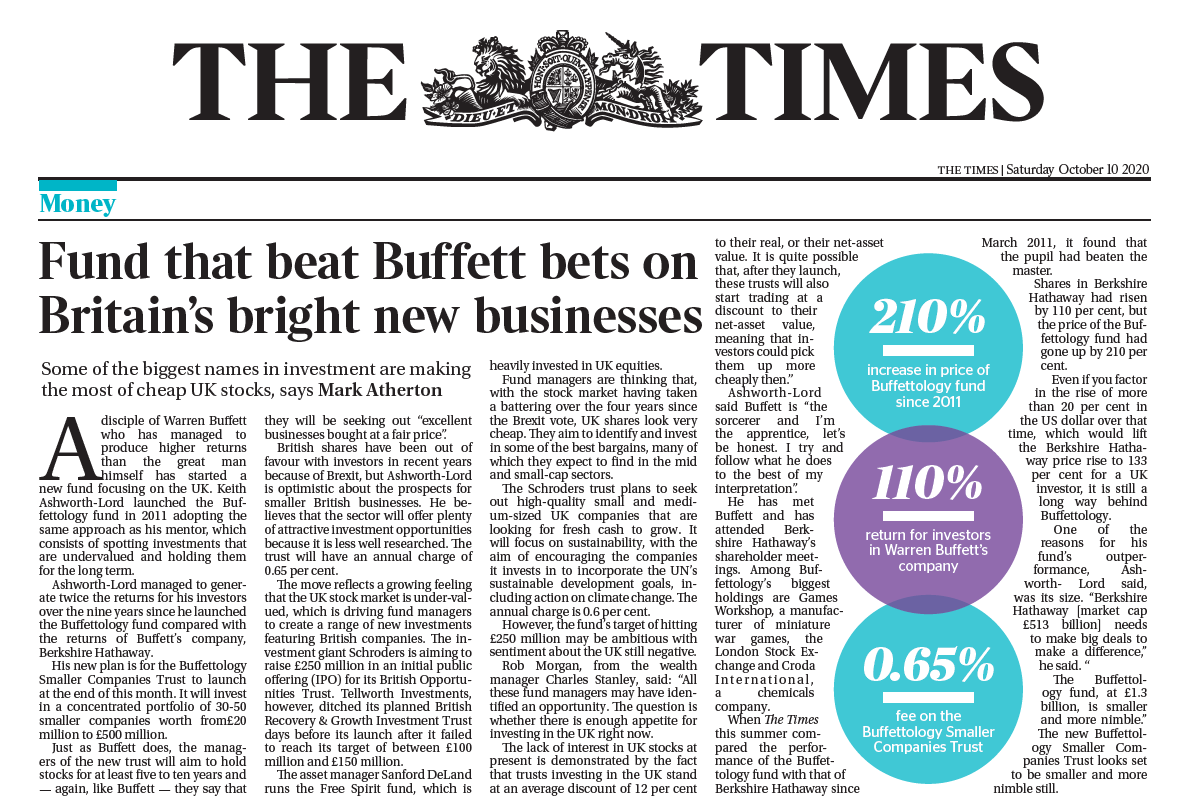

Britain’s ‘Warren Buffett’ To Launch Trust To Buy Small Businesses .pdf

SDL’s Planned Buffettology Investment Trust Hires Four Directors

SDL Plans Buffettology Smaller Companies Investment Trust Launch .pdf

‘I Ditched Retail – It Has Never Made Me Any Money’ .pdf

Buffett’s British Pupil Learns From The Master And Then Beats Him .pdf

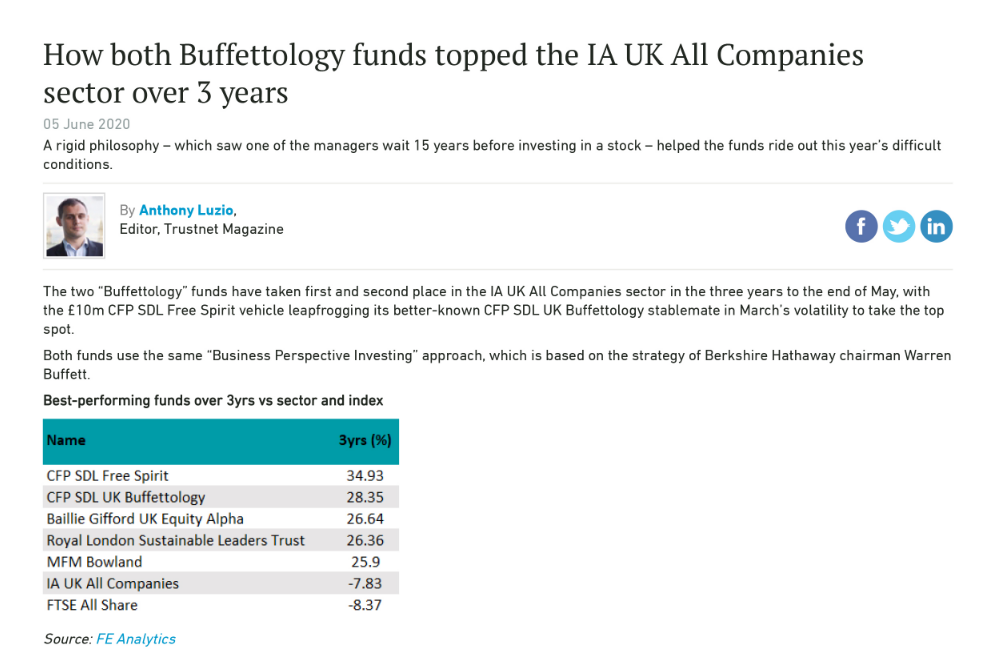

How Both Buffettology Funds Topped The IA UK All Companies Sector Over 3 Years .pdf

Living Up To The Name – Value Investor Insight .pdf

Back UK Winners With Buffettology .pdf

How To Find High Quality Shares That Might Pass The Warren Buffett Test .pdf

Sanford Deland Plans Global Buffettology Fund

Four Decisions That Meant This UK Fund Was One Of The Few To Make Money In 2018

KEITH ASHWORTH-LORD A British Buffett .pdf

Never Doubt Yourself and Be Patient

Warren Buffett Fans Can Follow Their Leader .pdf

How The Top UK Fund Shows Buffett’s Process Has Successfully Crossed The Pond .pdf

Sage Of Manchester? Buffett-Inspired Investor Tops UK Stock-Picking League

Conbrio Gets Money Observer’s Best Smaller UK Growth Fund Award for 2015 .pdf

Fund Fact Sheets .pdf downloads

Fact Sheet Review – 2016

Fact Sheet Review Of 2016 .pdf download

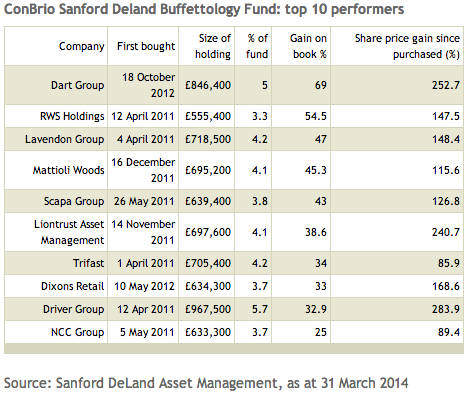

BUFFETTOLOGY FUND DELIVERS 60 PER CENT IN THREE YEARS

By Moira O’Neill ~ 23 April 2014

Three years ago, Keith Ashworth Lord set out to replicate Warren Buffett’s investment philosophy for the UK market with the launch of the ConBrio Sanford DeLand UK Buffettology Fund (GB00B3QQFJ66). But with hindsight, March 2011 was not the best time to launch a UK equity fund – even one with a dream name for marketers, as three months later stock markets tanked.

In the early months, Mr Ashworth Lord struggled to raise money for the fund. “It has not been plain sailing,” he says. But things picked up after a rocky first year and the fund has seen some decent inflows based on good performance in its second and third years.

In 2012, the fund returned 34.2 per cent against 8.2 per cent for the FTSE All-Share index, and in 2013 the fund returned 36 per cent against 16.7 per cent for the All-Share. “I never thought we’d do two years running of 30-plus per cent performance. It’s usually the exception rather than the rule,” he says.

Mr Ashworth Lord’s investment strategy for the fund is based on identifying companies that provide a “holy trinity” of qualities. A company must have:

1. Enduring franchise with growth prospects and pricing power;

2. High average and incremental returns on invested capital and equity;

3. Converts most if not all accounting earnings into free cash flow.

Having launched at 100p, the fund’s price was 160.22p on 31 March 2014 and it now has £17m under management. “We’re okay up to £50m – there’s no threat to our style. Beyond that up to £100m, it will become progressively harder to do smaller stuff that makes a difference,” he says.

Eight of his holdings are in Alternative Investment Market companies, eight are small cap or fledgling companies. He also has three FTSE 100 companies and nine FTSE 250 companies.

However, Mr Ashworth Lord feels that 28 stocks is too many. “Twenty five is more comfortable for me,” he says. “It’s partly the resource issue. I’m a firm believer that the more you load into your portfolio at the edges, the less you know about your original purchases.”

He also feels that his portfolio turnover rate (PTR) has been too high. “A 12.9 per cent PTR is only an eight-year average holding period. It still looks a bit much,” he says. “A 5 per cent PTR is ideal – which means you hold the stock for 20 years. A 10 per cent PTR should be the absolute maximum, meaning you have a 10-year minimum holding period. Sweet Group is the only stock I’ve sold this year. I aspire to be a bit like Nick Train [manager of Finsbury Growth & Income Trust (FGT)] and have a 0 per cent PTR some years.”

However, he is constrained by retail fund regulations. A UCITS fund can invest up to 10 per cent in a single company provided the total value of such holdings does not exceed 40 per cent of the value of the fund. “Twice in 2011, I was forced to sell Driver Group (DRV) because it went over 10 per cent of the portfolio,” he says.

Keith Ashworth Lord CV

Prior to founding Sanford DeLand Asset Management, Keith Ashworth Lord was a self-employed consultant working with a variety of stockbroking, fund management and private investor clients. He won three top-three sectoral, and one top-10 general Thomson-Reuters StarMine stock-picking awards in 2008, 2009 and 2010. His career spans over 30 years in equity capital markets, working in company investment analysis, corporate finance and fund management. He is a chartered fellow of the Chartered Institute for Securities & Investment and holds the Investment Management Certificate. He has a first degree in natural sciences and a Master’s in management studies.

His original purchases for the portfolio continue to perform well as the “bedrock of the fund”. These include RWS Holdings (RWS), Diageo (DGE) and GlaxoSmithKline (GSK).

Dart Group (DTG) and Dixons Retail (DXNS) have also been big winners for the fund. “People were saying Dixons wasn’t going to survive,” he says. “I went round the stores and was impressed with the people. I started buying Dixons at 18p and bought up to 40p.” Dixons is now trading at 46.21p (22 April 2014).

“Dart Group looked incredibly cheap when I bought it – it had a price-earnings ratio of three. Lots of companies in the portfolio have recovery or late-cycle potential.”

Games Workshop (GAW) is the only big loss he is running. “I’m down 15 per cent but I’m sticking with them to get though.” Pre-tax profits and revenues for the six months to 1 December 2013 were hit by changes to the structure of its retail chain and declining sales among independent stockists. “There are short-term problems due to converting to the one-man store format and they also need to target more cost cuts, but I think they will get it right,” he says.

Mr Ashworth Lord prides himself on real research. “I like to sit with the chief executive,” he says, “to find out what makes them tick and have an edge. I don’t like people who are full of self importance. I like going out to kick the tyres and see the businesses. The question is does the reality on the ground fit with what you see in the numbers. I spent a whole afternoon with Games Workshop, trying to get into the minds eye of what they have done and what needs doing.”

He admits this approach doesn’t work for the larger companies. “I prefer to be on my own. But Rotork (ROR) and Croda (CRDA) do investor days so I’m not on my own. With big companies such as Diageo and GSK you won’t get a one-to-one meeting.”

He added AG Barr (BAG) to the portfolio last year because he thought the planned tie-up with Britvic made sense. “I was livid when the deal was referred to the Competition Commission,” he says. “They jumped the gun and caused the deal to fall through. The UK lost the opportunity to have a company to stand up to Coca-Cola. AG Barr still ticks the box for Buffettology. But my biggest sorrow of last year was that the merger didn’t happen.”